Evaluating Earned Income Tax Credit (EITC) policies potential for violence prevention

Fact Sheet Outlines Health and Safety Implications of EITCs

The federal earned income tax credit (EITC), the largest cash transfer program for low-earning workers in the United States, is an economic policy intended to reduce poverty. Each year, the EITC program provides earning subsidies in the form of tax credits to certain workers based on their pretax earnings, marital status, and number of children. According to the Tax Policy Center, EITC credits are claimed by nearly 40 percent of families with children and 16 percent of families overall.

Twenty-eight states, the District of Columbia, and Puerto Rico, have enacted supplemental EITCs, most of which offer a percentage of the federal credit to the same families. Previous research has examined the variability in the existence, type, and financial assistance provided by state EITCs to examine the impact of these policies, particularly on health and well-being. However, research on whether EITC are effective in preventing multiple forms of violence is limited.

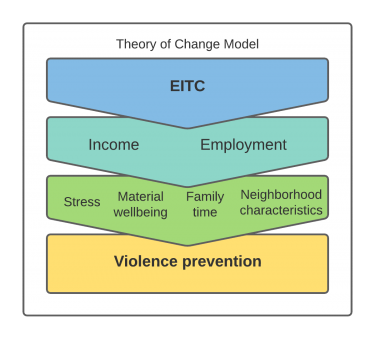

A multidisciplinary team of researchers with the University of Washington Department of Epidemiology and Evans School of Public Policy and Governance evaluated existing data and conducted a natural experiment guided by a specific Theory of Change model (see figure) to publish an EITC & Violence Prevention Fact Sheet. Their analysis explored policy variations resulting from the adoption and expansion of state EITCs from 1986-2017, and their impact on child maltreatment, youth violence, intimate partner violence, sexual violence, and suicide.

The results outlined in the EITC & Violence Prevention Fact Sheet indicate that increased EITC was associated with declines in child neglect, child maltreatment, suicide attempts and deaths. Additionally, states which increased the amount of EITC benefits, saw fewer reports of mental distress and poor physical health among adults with no education beyond high school. These findings support several policy actions to inform economic assistance policies that can prevent violence and improve population health, including:

- Maintaining or expanding the federal EITC

- Considering changes to federal and state EITC eligibility rules to improve access

- Creating EITCs in states that do not have an EITC

- Increasing benefit levels of existing state EITCs

- Supporting outreach and tax filing services to encourage eligible families to apply for the EITC

Additional information about EITC and violence prevention can be found here.

This fact sheet was developed by Ali Rowhani-Rahbar (PI), Heather Hill, Steve Mooney, Frederick Rivara, Caitlin Moe, Nicole Kovski, Erin Morgan, and Kim Dalve. Funding for this research was provided by Cooperative Agreement Award U01CE002945 from the Centers for Disease Control and Prevention.

Suggested citation: University of Washington Department of Epidemiology. EITC & Violence Prevention Fact Sheet. 2021. [Date accessed site].